Financial Goals and Investment Basics: Your Path to Financial Success

Taking control of your finances doesn't have to feel overwhelming.

The key is starting with clear goals and understanding the basics of growing your money over time. Whether you're just beginning your financial journey or looking to refine your approach, these two fundamental areas will set you up for long-term success.

TL;DR:

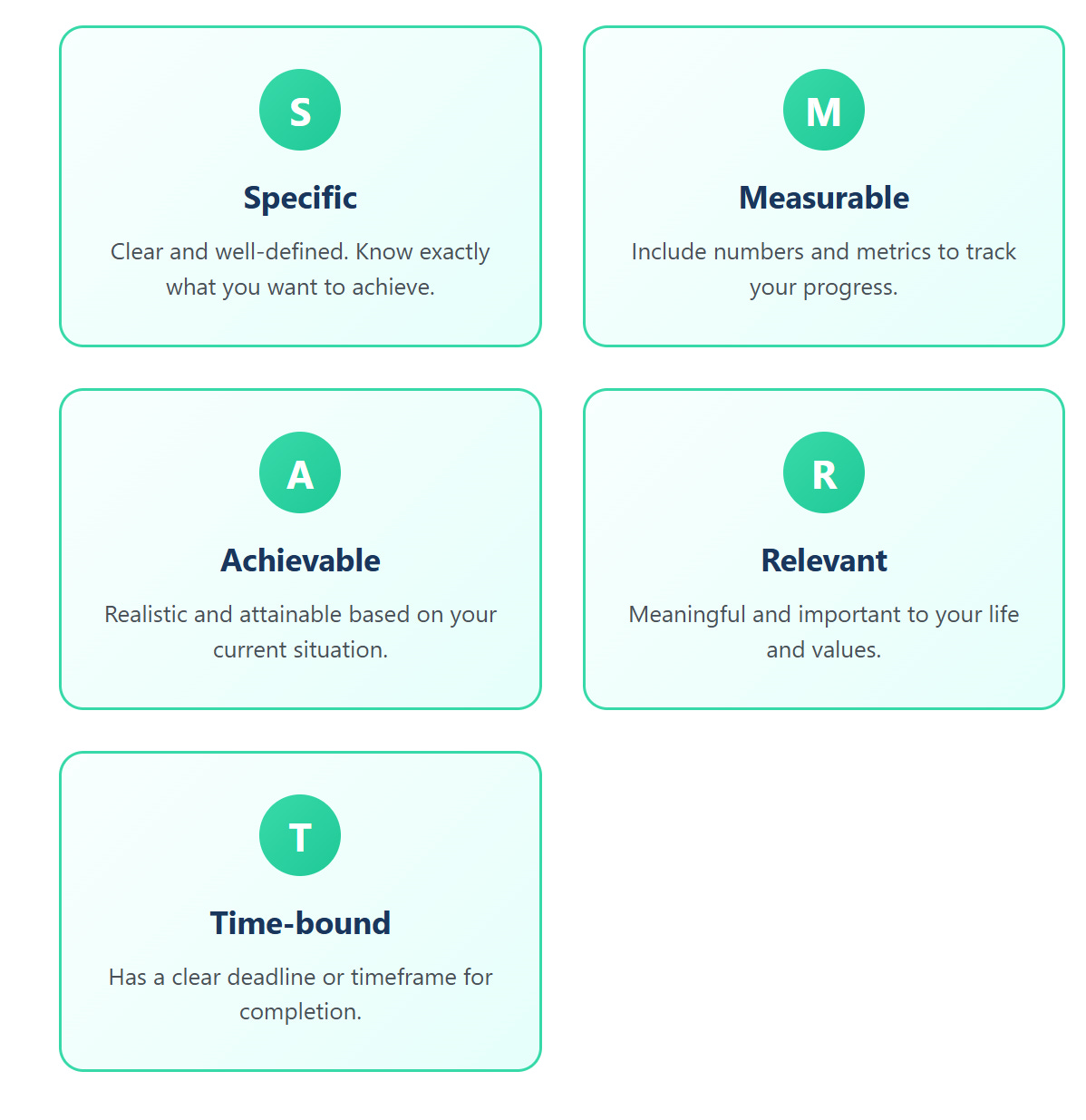

Start with clear short-term (1–3 years) and long-term (3+ years) financial goals using the SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound). Write them down and review regularly.

Then, learn to invest early and consistently. Use diversified, low-cost index funds or ETFs instead of picking individual stocks. Stay disciplined through market ups and downs—time in the market beats timing the market.

Even small, consistent steps like saving $25/month matter. Your goals and investments should align—cash for short-term needs, stocks for long-term growth. The key is starting now.

Setting Financial Goals That Actually Work

Think of financial goals as your money's GPS system. Without them, you're driving around aimlessly, hoping you'll somehow end up where you want to be. The most effective approach is to separate your goals into two categories: short-term and long-term.

Short-term goals are things you want to achieve within the next one to three years. This might include building an emergency fund, saving for a vacation, or putting money aside for a car down payment. These goals should be specific and measurable. Instead of saying "I want to save more money," try "I want to save $7,000 for an emergency fund by December 2026."

Long-term goals stretch beyond three years and often involve bigger life changes. Think retirement savings, buying a home, or funding your children's education. These goals require more patience and consistent effort, but they're where compound interest really works its magic.

The SMART framework can transform vague financial wishes into actionable plans. Make your goals Specific (exactly what you want), Measurable (with clear numbers), Achievable (realistic for your situation), Relevant (important to your life), and Time-bound (with deadlines). For example, "I will contribute $500 monthly to my retirement account for the next 20 years to accumulate $300,000 by age 65" hits all these criteria.

Don't forget to write your goals down and review them regularly. Life changes, and your goals should evolve with your circumstances. What seemed important at 25 might shift when you're 35 with different responsibilities and priorities.

Investment Basics: Making Your Money Work for You

Investing might seem complicated, but at its core, it's simply putting your money to work so it can grow over time. The earlier you start, the more time your money has to compound and multiply.

The best place for most people to begin investing is through retirement accounts. These accounts offer advantages that can significantly boost your long-term returns. Plus, if your employer offers a retirement contribution match, contribute at least enough to get the full match. It's essentially free money that you're leaving on the table if you don't take advantage of it.

Once you're contributing to retirement accounts, you'll need to choose investments. This is where diversification becomes crucial. Instead of putting all your money into one company's stock, spread it across different types of investments. Think of it like not putting all your eggs in one basket. If one investment performs poorly, others might do well and balance things out.

Index funds and exchange-traded funds (ETFs) are excellent options for beginners because they automatically diversify your money across hundreds or thousands of companies. A total stock market index fund, for instance, gives you a tiny piece of nearly every publicly traded company in the country. This spreads your risk while keeping costs low.

The key to successful investing is consistency and patience. Market ups and downs are normal and expected. Instead of trying to time the market or chase hot stocks, focus on investing regularly regardless of what the market is doing. This approach helps smooth out the inevitable bumps and reduces the impact of market volatility on your long-term returns.

Remember that investing is a marathon, not a sprint. The stock market has historically rewarded patient investors who stay the course through various economic cycles. While past performance doesn't guarantee future results, the long-term trend has been upward, making time your greatest ally in building wealth.

Bringing It All Together

Your financial goals and investment strategy should work hand in hand. Your short-term goals might be funded through high-yield savings accounts or short-term CDs, while your long-term goals benefit from the higher potential returns of stock market investments.

Start where you are, with what you have. Even if you can only invest $25 or $50 a month initially, that's better than waiting until you feel "ready" with a larger amount. The habit of consistent investing is more valuable than the initial amount, and you can always increase your contributions as your income grows.

The most important step is the first one. Whether that's opening a retirement account, setting up automatic transfers to savings, or simply writing down your financial goals, taking action today puts you ahead of tomorrow's procrastination. Your future self will thank you for the decisions you make right now.

The information in this post is for educational and informational purposes only. It reflects the author’s personal research and analysis, which may be subject to error or omission. This is not financial, investment, or trading advice. Always conduct your own due diligence and consult with a qualified financial advisor before making any investment or trading decisions.